I’ve been doing some research on portfolio hedges using Quantconnect and it’s quite interesting. Here are the results from backtesting a ‘Protective SPY Put’ hedge.

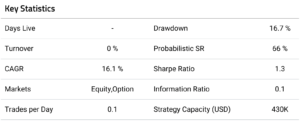

Summary of Results:

It’s proven to be effective, but there is some selection bias at play. ie: In my backtest, I’ve picked Put options that are ‘just the right’ distance away from spot price. Hindsight is always 2020. Which shall we pick for the future? I believe VIX Call hedging is more effective, due to the relative stationarity of the VIX movement, and its relation to SPY.

The Backtest:

For testing purposes, the portfolio is all SPY shares, except for 0.5%, which is allocated to OTM SPY Puts to guard against a market downturn. Specifically, we buy 60 DTE puts at 30 Delta strikes (reasonably OTM), and we roll them every 30 days.

This hedge is most effective during COVID, as can be expected, but does weigh down the portfolio otherwise. That said, such a hedge could be a reasonable complement to a well diversified portfolio.

If you’d like to tinker with this, here’s a link to the backtest results, with code. It’s also embedded at the bottom of this article.